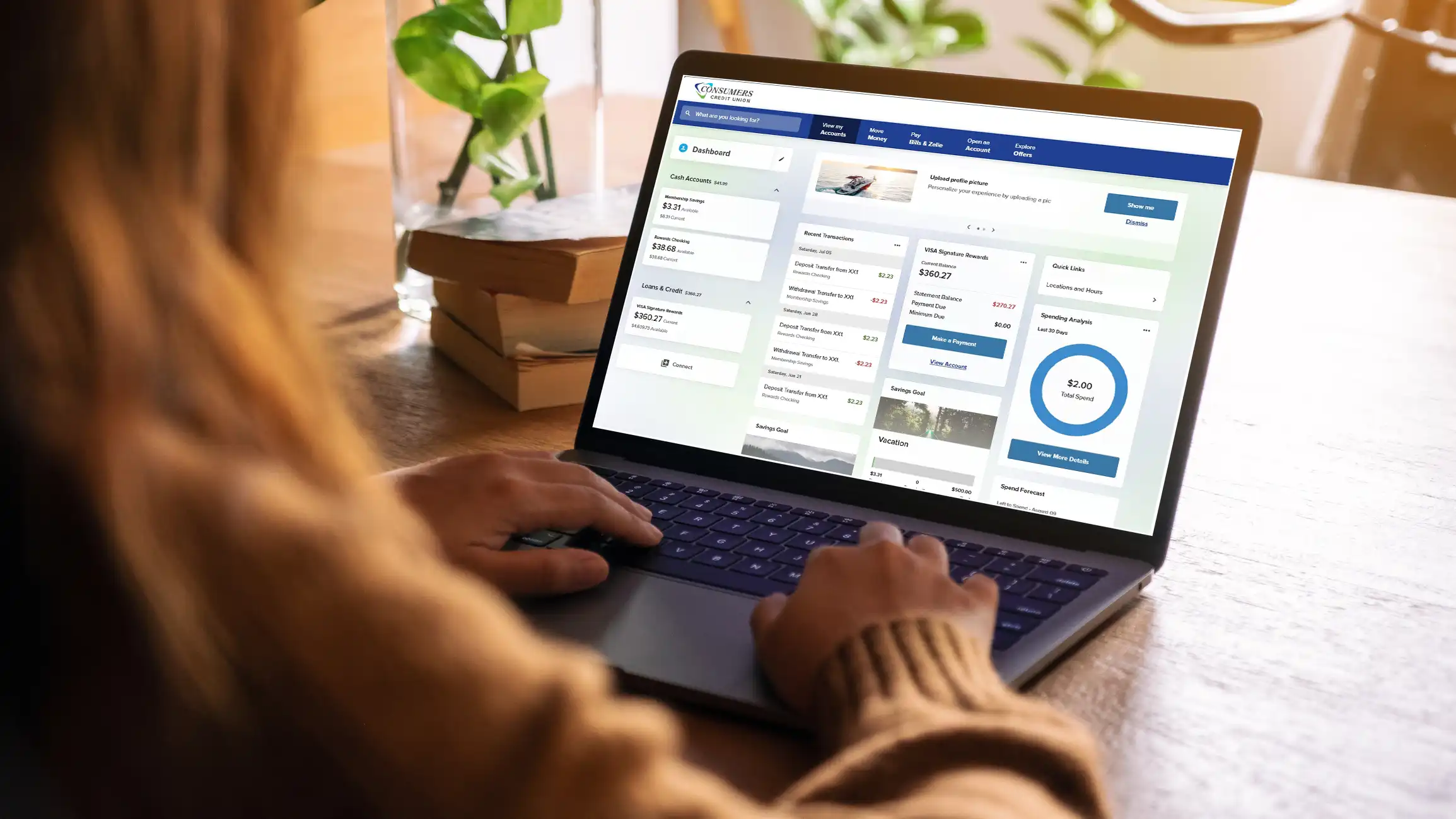

Digital Banking

Secure & convenient.

Count on digital banking.

Manage your money anytime, anywhere with the convenience of digital banking.

Centralized Accounts

All your account needs and features in one place – Add external accounts too.

Personalized

Customize your digital banking dashboard, view personalized offers and helpful information.

Financial Tools

Track your spending by category, create savings goals, calculate net worth and more.

E-Statements & Documents

Go paperless with digital documents that are always at your fingertips.

Bill Pay

The easiest way to pay your bills. Schedule recurring payments. Includes a convenient bill finder.

The fast, safe, and easy way to send and receive money with friends, family, and others you trust.

Card Management

Activate / lock your card, add to mobile wallet, set alerts & spending controls, add travel notifications.

Deposit Anywhere

Securely deposit checks anytime using the CCU mobile app, no branch required.

We take security seriously. Additional features such as card controls, digital wallets, security alerts, and multi-factor authentication are also available.

Many of these features and more are available for Business Accounts.

Already a CCU member?

Register for Digital Banking

and download our secure app

Not a member, sign up today.

Digital banking questions?

We can help!

Whether you're new to digital banking, or new to our tools, we'd like to assist with providing the answers you need.

Learn About Our Digital Upgrade