Money when you need it — for just about anything you need.

Save thousands with an unsecured, fixed-rate, low-interest personal loan.

Consolidate & Pay Down Debt

Get Emergency Funds

Cover unexpected expenses with a fixed-rate loan to avoid compounding interest rates.

Start Home Improvements

Cover Medical Expenses

Dream Big

Access Funds Same-Day

Applying is as easy as 1-2-3

Whether you're planning something exciting or dealing with something unexpected, we're here to help. At CCU, we're in your corner with flexible loan options for every budget.

Apply for a Loan

Apply online, in person, or by phone.

- Online: Log into digital banking, select the "Open an Account" tab, then choose "Personal Loan."

- In Person: Visit any CCU branch.

- By Phone: Call us at 847.672.3408 and we'll guide you through the process.

Calculate Your Monthly Payment

Provide the requested information to receive your personalized loan offer. Once you get your prequalified rate, select the terms and payment plan that work best for you.

Receive Your Funds

Accept your loan offer and choose the CCU account to deposit the funds. Sign the documents and receive your funds as quickly as the same day.

Personal Loan Rates

| Type | Terms & Conditions | Term | APR as low as* |

|---|---|---|---|

| Share Secured | Based on loan amount and credit qualifications | Variable** | |

| Personal Loan (Unsecured) | Based on loan amount and credit qualifications | 8.99% |

*APR = Annual Percentage Rate. Not all applicants may qualify for the fixed base rate. Your rate is determined by your credit history. Rates listed include applicable discounts of 0.25% APR. For details, please ask a CCU Rep. VISA, variable, overdraft protection, real estate, share secure, and existing CCU loans are excluded from any rate deductions. An example of payment terms is as follows: a personal loan financed with an APR of 8.99% and a term of 36 months would have a monthly payment per thousand dollars of $31.80.

**The Share Secured loan is a variable rate loan and may increase after consummation.

NOTE: CCU does not offer Personal loans for tuition or educational purposes.

Current Debts

Consolidation Loan

| APR | 0.00% | 10.39% |

| Monthly Payment | $0.00 | $0.00 |

| Time to Payoff | 0mo | 0mo |

| Loan Fee/Points | $0 | $1,250 |

| Upfront Cash Flow | $0 | $0 |

| Total Payments | $0 | $0 |

| Total Interest | $0 | $0 |

Purchase and refinancing options are available to fit your budget.

Powersports

Enjoy the ride with a Powersports Loan from CCU. Great, low rates for all new and used bikes, jet skis, ATVs or any powersport ride. Have a loan elsewhere? Look into refinancing to see if you can save on your monthly payment.

- Low rates, flexible terms.

- No prepayment penalty.

- A quick and easy approval process.

Recreational Vehicles

Our recreational vehicle loans offer competitive fixed rates for motorhomes, campers, and boats for purchase or refinance.

- 100% financing for qualified members

- Great fixed rates with flexible terms

- Refinancing available on loans from other lenders.

- A quick and easy approval process.

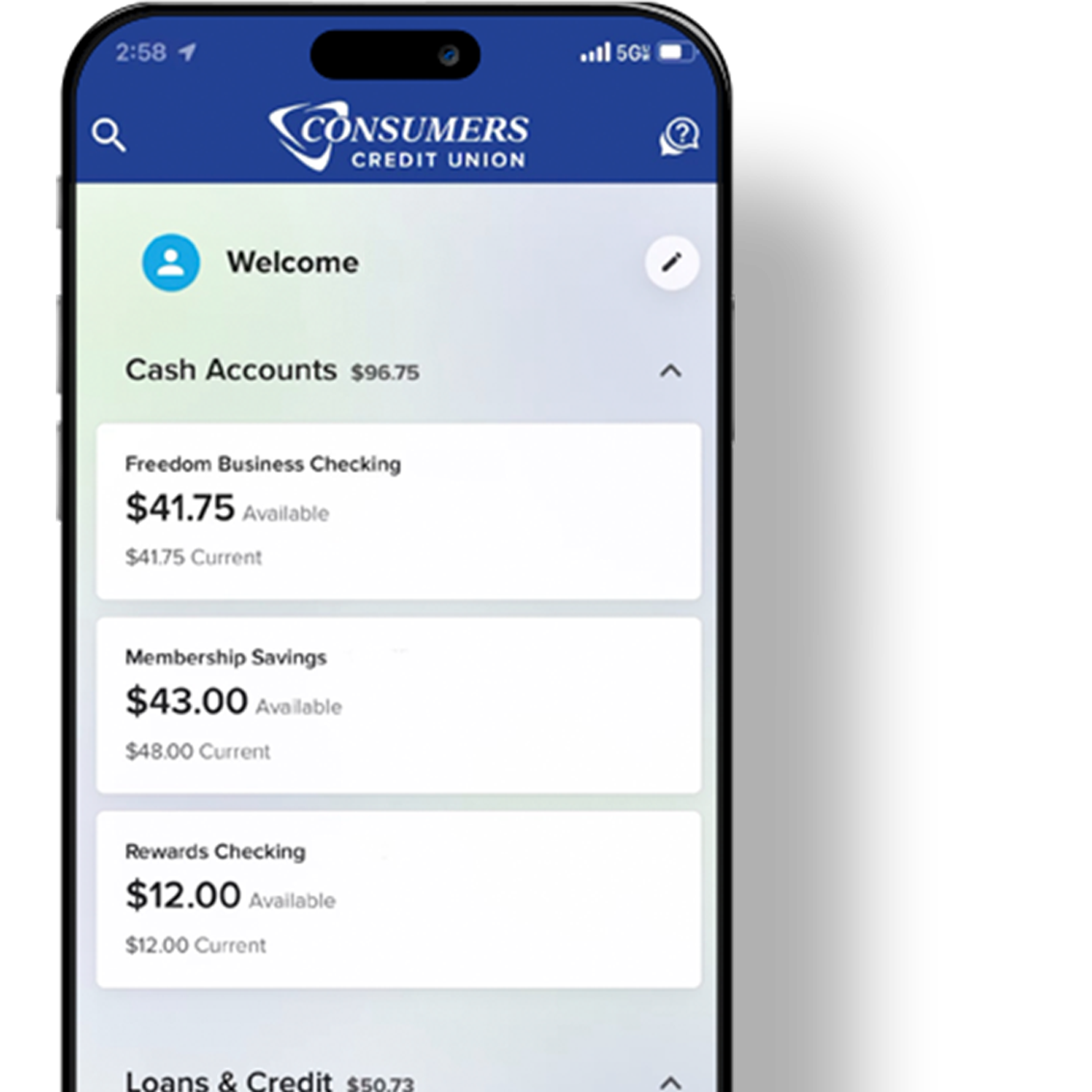

Combine your CCU + Visa Credit Card

Open a CCU Rewards Checking account and manage your money, your card, and your rewards—all with one login.

CCU Savings Account

Open a CCU Savings Account and take the first step toward your financial goals. Whether you're building an emergency fund or saving for something special, you'll earn competitive dividends and enjoy easy access to your money.