Student Choice® Checking account for members 13 to 17 years old.

Enjoy the following FREE benefits*:

- Get paid up to two days early with early direct deposit

- Debit Card with $310 daily limit

- Up to $25 per month reimbursement for ATM fees**

- No monthly maintenance fees for anything

- Convenient Digital Banking, and Bill Pay

- Over 30,000 ATMs & over 5,000 shared branches

Contact Us

Student Choice® Checking FAQs

To open a Student Choice ® Checking account, please call us at 877.275.2228 to make an appointment to visit us in person to assist you with opening your account, or visit your closest branch location to learn more.

What will happen to the account when the student member reaches the age of 18?

The member will receive an email notice to switch their account type to a new checking option, such as Rewards Checking.

What will happen to the parent member’s joint ownership status when the student member reaches the age of 18?

The parent member may or may not remove their joint account ownership when the student member transitions to a new checking option.

Identification Requirements to open an account

More checking options to explore.

Savings

Find the right savings account for you. We offer flexible options to help you earn valuable dividends.

Learn More

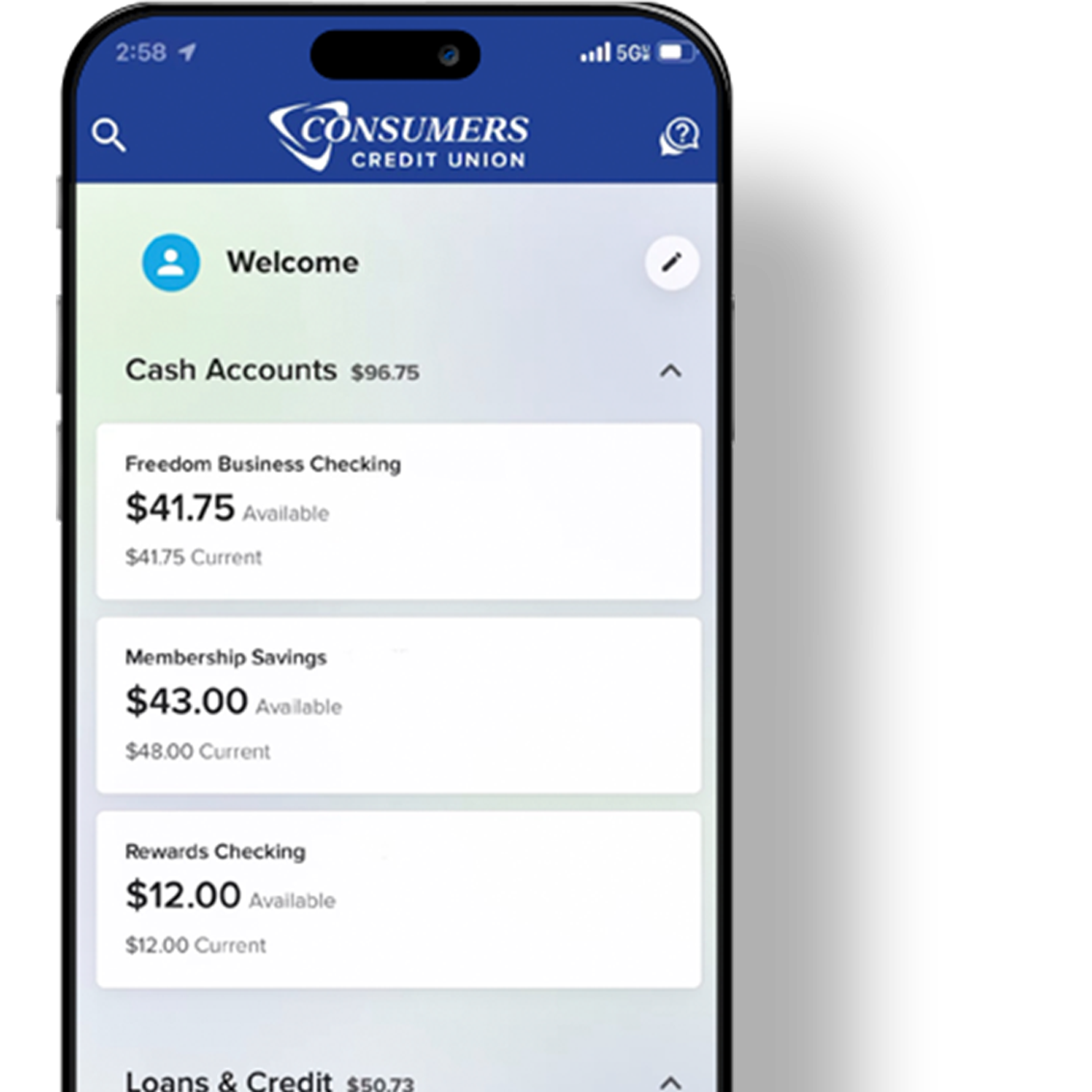

Free Checking

Pay bills, get cash, and transfer money, all without monthly fees. Plus, zero minimum balance.

Learn More

*Minimum $5.00 opening deposit required.

**We offer over 30,000 surcharge-free ATMs nationwide and we refund fees charged by other bank ATMs when you meet your minimum Rewards Checking requirements.